New Visa Stay Secure Study Reveals 7 out of 10 Ukrainians are Concerned About Their Loved Ones Falling Prey to Scammers

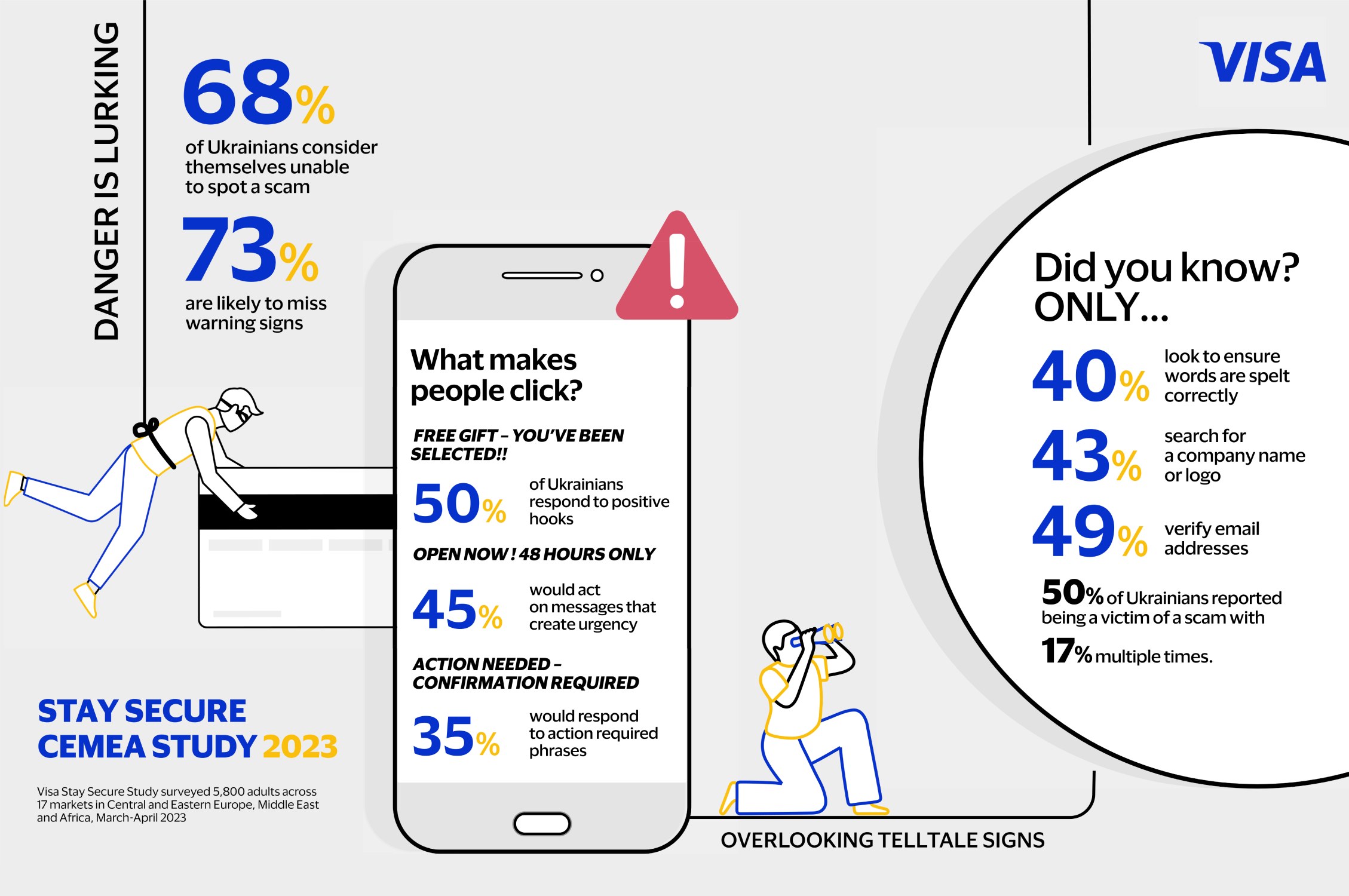

- 7 out of 10 Ukrainians are concerned about their loved ones responding to a fraudulent message asking to confirm the account data, and 68% doubt their ability to spot an online scam.

- 1 out of 2 Ukrainians would act if a message had a positive hook, such as: “Free gift”, “You’ve been selected”, “You are a winner”.

- Ukrainians are the least likely to trust requests to reset their password due to a potential data breach: 85% of respondents listed such messages among the top three most suspicious.

KYIV, September 13, 2023 — 7 out of 10 Ukrainians are concerned about their loved ones responding to a fraudulent message asking to confirm the account data, according to Visa’s latest Stay Secure Study¹ conducted by Wakefield Research in 2023.

The level of awareness of fraudulent social engineering tactics is evidenced by the following: 73% of Ukrainians are likely to disregard the warning signs that suggest online criminal activity. The study also revealed that 1 out of 2 Ukrainians has been a victim of a scam at least once, and a further 17% have been tricked multiple times.

“In today’s digital-first world, scams are evolving in sophistication, with criminals using new approaches to trick unsuspecting consumers. Whether it’s a parcel held up at customs, a streaming subscription claiming to have expired, or a gift card from a favorite brand, scammers are adopting extremely persuasive tactics to deceive their victims. With the rapid growth in digital payments, it is essential now more than ever that consumers understand the language of fraud and act with a high level of caution,” explains Charles Lobo, Regional Risk Officer for Central and Eastern Europe, Middle East and Africa at Visa.

The Stay Secure Study is a part of Visa’s Pay Secure information campaign, which reflects Visa’s commitment to raising consumer awareness of possible online scam scenarios, teaching consumers more informed and safe behaviors, and increasing financial literacy. In Ukraine, the campaign is held in support of the National Bank of Ukraine's initiative to combat fraud, #ШахрайГудбай (Goodbye Scammer).

“Costly Confidence”: The Disconnect Between Awareness and Action

Key Findings of the Visa Stay Secure Study:

- False confidence leaves you vulnerable to deception. Respondents who consider themselves knowledgeable about cybercriminals’ tactics are more likely to click on a fake link or believe a scam offer. Thus, 54% of "knowledgeable" Ukrainians will buy into a message with positive news, and 42% will respond to a requested action, compared to those who doubt their vigilance (48% and 32% respectively).

- People worry about the vulnerability of others. 7 out of 10 Ukrainians are concerned that their friends or families may respond to a fraudulent message asking to confirm the account data, and almost half (46%) worry that their loved ones will fall for a scam email offering a free gift card or product from an online shopping site. Additionally, 68% of respondents are concerned about seniors falling prey to online scams, and a quarter doubt the vigilance of children and minors.

- What makes people suspicious. Ukrainians are the least likely to trust requests to reset their password due to a potential data breach: 85% of respondents listed such messages among the top three most suspicious. Less suspicious types of communications are updates regarding delivery or shipping (just 28% listed as a top three source of suspicion), marketing communications regarding a sale or new product offering (27%), or an invitation to provide feedback on a recent experience (17%)—all of these can be used by scammers.

- Overlooking telltale signs. 49% of Ukrainians reported looking to ensure a communication is sent from a valid email address, while 43% will check if the company name or logo is attached to the message. Fewer than half of correspondents look for an order number (42%) or an account number (32%), and 40% check if the words are spelt correctly.

Decoding the Language of Fraud

Scammers try different approaches to craft messages that appear genuine and compel recipients to take immediate action. The Visa Stay Secure Study identified prevalent patterns in the language most associated with scams and how vulnerable respondents in Ukraine are.

- Orchestrating Urgency: Cybercriminals often feign urgency to spur people into action, such as clicking a link or responding to a sender. 27% of Ukrainians will fall for messages about a security risk, such as a stolen password or a data breach, while a notice from a government entity or law enforcement can trick 32%.

- Sharing Positive News: 1 out of 2 respondents would take action if a message had a positive hook, like “free gift,” “you’ve been selected,” or “you’re a winner”. 35% of Ukrainians would click on a link or reply to a message that offered a financial opportunity, while Gen Zers are the most likely to fall for this hook (48%), and most seniors are suspicious of such offers (18%).

- Action Required: 35% would respond to action-required phrases, though Ukrainians are most suspicious of requests to reset their password.

Spot the Signs: How to Catch Scams in Action

Consumers can better protect themselves by taking a few extra moments before clicking, including understanding the language scammers use.

Among simple but effective best practices:

- Keep personal account information to yourself.

- Don’t click on links before verifying that they’ll take you where they say they will.

- Regularly check purchase alerts, which provide near real-time notification by text message or email of purchases made with your account.

- Call the number on corporate websites or the back of your credit and debit cards if you are unsure if a communication is valid.

Visit Visa’s Stay Secure Page for more insights from the 2023 Study and follow us on social media (Facebook, Instagram) to learn about the language of fraud and how to avoid being a victim of widespread scams.

To prevent the increase in online fraud and tackle the challenges revealed by the study, Visa is launching an education campaign about payment security, “Pay Secure”, which will cover the topics of common scams, the language of online fraud and how to avoid falling for it.

Visa’s “Pay Secure” information campaign in Ukraine is held in support of the National Bank of Ukraine’s initiative to improve financial literacy and combat fraud #ШахрайГудбай (Goodbye Scammer).

About Visa’s Commitment to Protecting Payments and Commerce Ecosystem

While cybercrime persists in an increasingly digital world, Visa is tirelessly working behind the scenes to stay one step ahead. Worldwide, we have invested over $10 billion over the past five years in technology, including to reduce fraud and enhance network security. This has included $500 million on Artificial Intelligence (AI) and data infrastructure, enabling us to power 100 different capabilities that use AI to protect our clients and customers. More than a thousand dedicated specialists protect Visa’s network from malware, zero-day attacks and insider threats 24x7x365. In fact, over the last year alone, Visa proactively prevented $27.1 billion in potential fraud.

About Visa Inc.

Visa (NYSE: V) is a world leader in digital payments, facilitating transactions between consumers, merchants, financial institutions and government entities across more than 200 countries. Our mission is to connect the world through the most innovative, convenient, reliable and secure payments network, enabling individuals, businesses and economies to thrive. We believe that economies that include everyone everywhere, uplift everyone everywhere and see access as foundational to the future of money movement. Learn more at Visa.com.ua.